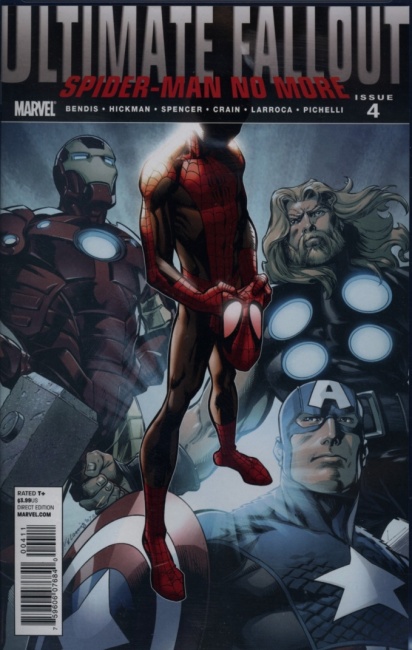

Over the weekend, Bleeding Cool noted the private sale of the original art to the cover of Ultimate Fallout #4 by Mark Bagley for a reported $225,000, setting a record for a piece of comic art created in the 21st century.

The cover is a pretty nice drawing and Bagley is a well-regarded pro, to be sure, but one suspects that the real draw is the first appearance of Miles Morales, one of the top two or three notable characters created for a major publisher in the past 25 years. It’s also a unique item in that co-creator Sara Pichelli’s interior artwork for the issue was created digitally, so there is, for now, no original to sell. Put a pin in that for a few paragraphs.

According to the story, the buyer is "rumored to be a known entertainment figure and notable art collector," which I guess narrows it down some. Obviously, there are figures in the entertainment world who can and have written six-figure checks for collectibles out of their bank accounts, or perhaps brought suitcases full of unmarked bills or bearer bonds to a hotel room.

But to me, the biggest mystery here is the form of payment. There is another class of buyer at work in the market right now, and even if this particular transaction may not fit the pattern, it’s something we may want to keep in mind.

A fair bit of coin. I suspect most readers are familiar with Bitcoin, or at least have heard the term even if you’re not entirely sure what it is. That’s because a single unit of Bitcoin is now closing in on a valuation of $50,000 in cold hard cash. Five years ago, it was more like $500, which represents a return of 10,000% over five years, and that’s factoring in a huge dip after a market boom in 2017. How’s your 401K doing?

Bitcoin (BTC) and comparable forms of exchange like Etherium (ETH) are known as "cryptocurrencies," partly because they are mysterious, I guess, but mostly because they are based on computational algorithms that are nearly impossible to decode by hackers. The underlying technology is called blockchain, and it relies on an open, distributed system for keeping track of digital assets such that any registered digital asset can have one and only one owner at a time.

What started out as a neat computer science experiment turned out to solve one of the biggest problems of the digital economy. Unlike physical stuff, computer files can be copied endlessly, and each copy is identical to the original. Traditional methods of copy-protected and "digital rights management" can be defeated by hackers, which means that you can have a theoretically unlimited supply online. Econ 101 tells us that if there is unlimited supply, the price of anything drops to zero, because it is nearly free to create another identical unit to fill demand. If there’s no scarcity, there’s no value, so there’s no point in "collecting" digital anything except to have it for yourself. Try reselling a digital comic you downloaded if you don’t believe me.

Because the blockchain gives people a foolproof way to ascertain whether a digital asset is an original or counterfeit, suddenly you can limit the supply of authentic digital stuff – let’s say, a form of currency – to an amount that is very slowly ground out by networks of computers working round the clock on very complicated mathematical formulas.

The long and short of this is that Bitcoin and Ether, which are products of blockchain technology, have soared in price as demand has far, far, far outstripped supply. And who got in on the ground floor of this bonanza? A bunch of young mostly-men with a geekish fascination in technology and a stubborn streak of know-it-all contrarianism. Sound like anyone we know?

From currency appreciation to art appreciation. Let’s say you took a flier on cryptocurrencies back in the early teens and are holding a wallet full of, say, 10,000 BTC along with some assorted "shitcoin" that you bought for pennies and are now worth a few bucks each. And let’s say you could own that very important piece of your adolescence for the equivalent of 5 BTC, roughly 0.005% of your holdings? Easy come, easy go, right?

And then think about the counterparty to that transaction. Sure, you could take dollars, which are legal currency and all. But a dollar today is likely to be worth a dollar, more or less, tomorrow. And Bitcoin? On January 21, 2021, 1 BTC was trading for $30,874 (a recent low). Less than a month later, it’s over $48,000. It should also be pointed out that taxation and regulation have not fully caught up to what’s going on in the world of cryptocurrencies, which might also add to their appeal. Same with collectibles, incidentally.

Getting back to my original question, when the medium of exchange can double in value in a matter of months, the questions of how and when a collectible was paid for turns out to be pretty important. If this sale went down last month and was denominated in BTC or ETH, the actual cash value to the buyer and seller at the time the deal was struck could have been significantly different. And both sides have a good reason to report the higher number, which is strictly speaking accurate.

Enter the cryptonauts. Even a couple of years ago, cryptocurrency was seen as a fad on the fringes of the economy, the sport of risk-crazy millennials and libertarian idealists. Today, you can buy and sell Bitcoin on PayPal; giant banks and brokerages like Morgan Stanley and JP Morgan are opening crypto trading desks; and Elon Musk just moved the market with news of a $1.5 billion stake.

Closer to home, auction houses like Heritage accept BTC and ETH for payment on physical goods, and Heritage has its first digital collectible – a Top Shot NBA digital trading card featuring Zion Williamson – up for auction in its February catalog. Current bid? $29,000 ($34,800 with buyers’ premium).

That’s worth a record scratch. Thirty grand for… a digital card, containing a 13 second highlight clip of the New Orleans superstar from his rookie year? Yes, digital collectibles are a thing, for the same reason – and using the same technology – as Bitcoin. There’s a limited supply, sometimes a unique supply, of authentic items registered on the blockchain, and collectors are going crazy for them. (Disclosure: I am doing consulting work with a company in this space).

There’s also a nascent business in crypto art: digital original works using the same tech, selling on various platforms but resalable anywhere because, like physical goods, they are unique and fully owned by whoever has the private key. One of the top sellers right now? A unique digital painting of Batman called "Genesis" by Trevor Jones, based on a pencil and ink drawing by Jose Delbo, a steal at 302.5 ETH. That’s $551,926.38 as of this writing in what the crypto-community calls "fiat currency," although it was more like $115,000 three months ago at the time of the last sale.

Huh. Digital art selling for digital money. What will they think of next?

The opinions expressed in this column are solely those of the writer, and do not necessarily reflect the views of the editorial staff of ICv2.com.

Rob Salkowitz (@robsalk) is the author of Comic-Con and the Business of Pop Culture.

By Rob Salkowitz

Posted by Rob Salkowitz on February 15, 2021 @ 4:20 pm CT