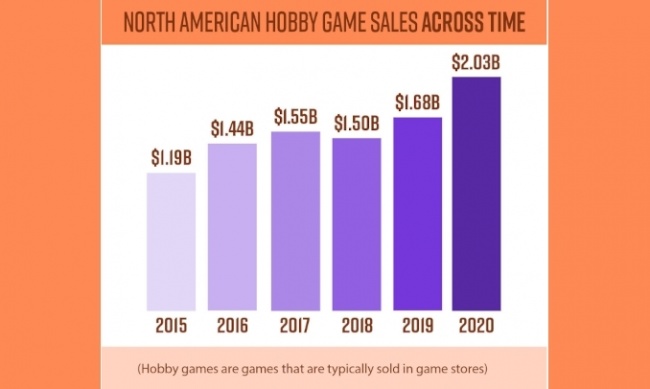

Despite the many challenges of doing business during a global pandemic, hobby game sales in the U.S. and Canada grew 21% to $2.035 billion in 2020, up from $1.675 billion in 2019. Every category of games was up, fueled by stay-at-home orders that limited entertainment options. Collectible games contributed the biggest portion of the dollar growth, and RPGs the highest percentage growth.

Results by channel were mixed, with the hobby channel (especially its online portions), Kickstarter, mass merchants, and large online retailers all up, and specialty retail chains down.

Collectible games went into 2020 with good momentum; the category grew 19% in 2019. But 2020’s 24% growth eclipsed that rate, and it could have been higher if printing plants had been able to keep up with demand.

Games Workshop shut down completely for a period early in Covid and never caught up with demand, suppressing the non-collectible miniatures growth rate below what it could have been, but the category still grew 17% to $415 million.

Hobby board games had shown signs of maturing in 2019, but that was quickly reversed as board games emerged as one of the few activities that could be done by small household groups during a pandemic. The category grew 19% to $435 million.

The hobby card and dice game category was on a negative trend in 2019, but driven by the same Covid factors that affected board game sales, turned around in 2020, growing 19% to $155 million.

RPG sales grew rapidly in 2019, up 23%, but even faster in 2020, up 31% and breaking $100 million for the first time, at an estimated $105 million.

We define "hobby games" as those games produced for a "gamer" market, generally (although not always) sold primarily in the hobby channel of game and card specialty stores. We define the "hobby games market" as the market for those games regardless of whether they’re sold in the hobby channel or other channels. Our estimates include sales in the U.S. and Canada.

The total hobby games market estimate is derived from estimates for five individual categories: collectible games (which include Trading/Collectible Card Games, Collectible Miniatures Games, and Collectible Dice Games), miniatures (non-collectible), board games, card and dice games, and roleplaying games.

Our primary means of collecting data about hobby games sales is interviews with key industry figures with good visibility to sales in various categories and channels. We also review data released by publicly traded companies, publicly available NPD data, and Kickstarter data and analysis, especially that released by ICO Partners. There were no major changes in methodology for 2020.

For in-depth analysis of 2020 hobby game sales on our Pro site, see "Hobby Game Sales Over $2 Billion in 2020 – In Depth."

The full-length version of this article, along will all of our market analysis of 2020 and Spring 2021, appeared in Internal Correspondence #100, which is available on our Pro site (click here).

Pandemic Year Ends on Up Note

Posted by Milton Griepp on July 16, 2021 @ 3:16 am CT