Ending a process that began as it began opening distribution centers across the U.S., Amazon will be charging sales tax in all states that have one as of April 1, the company announced. This eliminates a competitive advantage that the online behemoth long had over brick and mortar stores, which because of their physical locations were required by law to charge sales tax.

Amazon has opened distribution centers in almost every state over the last few years, with 169 distribution and sortation centers worldwide as of the end of last year (see "Retail Giants Double Down on Fast Delivery"). Those physical locations put Amazon in the position of having to charge sales taxes in the states in which they’re located, so it is now taking the final step of charging tax in the last few states where it had not done so in the past, inclidng Hawaii, Idaho, Maine, and New Mexico.

As of April 1

Posted by Milton Griepp on March 27, 2017 @ 2:19 am CT

MORE COMICS

Second Title in Offbeat Manga Imprint

May 2, 2024

UFO Mushroom Invasion is the second title in the imprint, which will focus on vintage pulp, horror, and mystery manga.

To Help with M&A, Loyalty Program, More

May 2, 2024

Skybound Entertainment has continued its executive hiring binge with the addition of two more senior executives, to help with mergers & acquisitions and a new loyalty program.

MORE NEWS

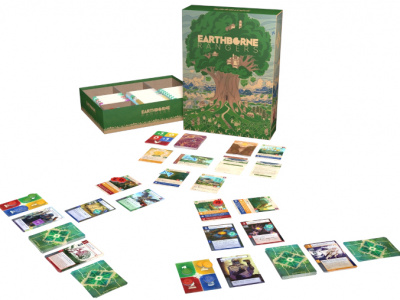

First Game from Andrew Navarro's Company

May 2, 2024

Earthborne Rangers, the first game from the company of longtime Fantasy Flight Games executive Andrew Navarro, will be released to trade.

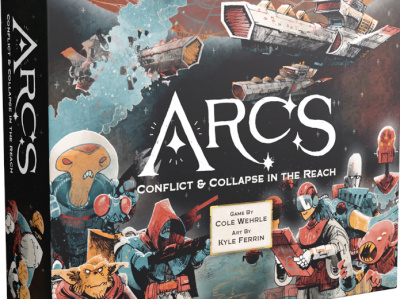

'Arcs,' from Leder Games

May 2, 2024

Leder Games will release Arcs, a new science fiction strategy game from the designer of Root and Oath, in October.