A new era in comic distribution dawns this week, with three distributors now shipping new releases to comic stores, a situation that has not occurred since the mid-1990s. We’ve clearly now entered a much more dynamic period, with longtime wholesale market leader Diamond Comic Distributors facing a level of competition that only the most long-term employees there have seen before.

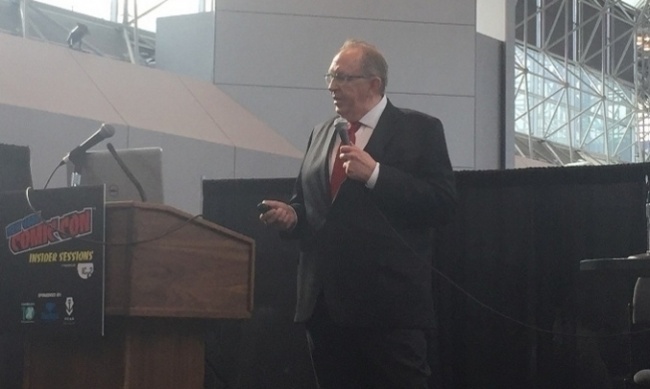

As someone who led a major comic distributor through much of the 1980s and the first half of the 90s (Capital City Distribution sold out to Diamond in 1996), during a period of market volatility, rapid growth, and intense competition, I thought it would be a good time to share my thoughts on the field of battle in this new era.

Since Capital sold out to Diamond in the mid-90s, Diamond has effectively been the only company wholesaling goods to many comic stores, and the most important supplier for all comic stores. It enforced that status with supplier agreements that bound its key publisher clients (and many mid-sized publishers) to exclusive relationships for one or more channels in exchange for various benefits beyond those enjoyed by non-exclusive suppliers.

But in recent years, as the graphic novel business became increasingly important to comic publishers and Diamond adapted slowly to the new reality, publishers began loosening their relationships with Diamond. This hit first at Diamond Book Distributors, the company division that sold graphic novels and other books to the book channel. A series of publisher clients left for the distribution arms of major book publishers, leaving Diamond Book with only Image Comics and Dynamite Entertainment as clients among the top seven comic periodical publishers.

Diamond’s hold on its periodical business in comic stores was also weakening, as DC negotiated a short-term out in its last North American deal with Diamond, and operated without a long-term deal at the end. IDW Publishing also went an extended period without a long-term agreement with Diamond.

When Covid hit and Diamond shut down for seven weeks in April and May of 2020, DC almost immediately indicated its dissatisfaction by opening two new distributors (one, Lunar Distribution, remains), which began shipping to retailers while Diamond was shut down. Other publishers’ reactions took longer, but have continued. This week, Penguin Random House Publisher Services begins as the exclusive distributor of Marvel periodicals to the comic trade; Diamond is offering Marvels to its customers as a wholesaler buying from PRHPS. Next June, PRHPS will also begin exclusively distributing IDW Publishing comics and graphic novels to the comic trade; Diamond will also offer IDW titles as a wholesaler buying from PRHPS.

As this new competitive era kicks off, I took a look at how the three distributors (Diamond, PRHPS, and Lunar) compare in variables important to retailers and publishers, and it sure looks like Diamond has a real battle on its hands. Here are the key variables important to retailers:

Price. On competitive lines (Marvel, and soon IDW), PRHPS holds an advantage of at least a couple of percent over Diamond on the biggest accounts, and of considerably more on smaller accounts. Diamond could raise prices on lines on which it has exclusive rights for retailers whose volume drops because they move their Marvel orders to PRHPS; but for now it has promised to hold pricing constant through at least the end of the year. Lunar has no competition on DC periodicals, so it’s basically up to DC to determine how much money it wants to keep and how much it wants to give to retailers that sell its products.

Credit/Collections. At 60 day terms for qualified accounts, PRHPS is offering the best standard terms of any of the distributors, and has experience selling to independent retailers from its book business, so knows the ins and outs of collections. Diamond has 40 years of experience in selling to and collecting from comic stores, and has helped many a current retailer through a tough period in the past, but has never offered terms that generous as a starting point. Being willing to work with a retailer whose payments slip to 60 days while they get them back to 30 is not as good as starting at 60 days, making the work-out less necessary to start with. The folks at Lunar, which is associated with retailer Discount Comic Book Service, have little experience managing receivables, and it shows. I’ve heard multiple stories from retailers who ran into some kind of problem with Lunar and had trouble getting it straightened out because of lack of communication or other issues, leading to held shipments and lost sales.

Information Technology. This one’s close between PRHPS and Diamond. PRHPS has better ability to manage backlist and to manage the data associated with its product lines. Diamond, on the other hand, has a couple of services, including its ComicSuite POS system and its Pull-List service, that provide a competitive advantage over PRHPS. I’ve had retailers tell me that the ease of exporting orders to Diamond from ComicSuite, which is apparently smoother than exporting orders to PRHPS or Lunar, affects where they place orders. Lunar’s IT is fine for what it does, but has neither PRHPS’s sophistication nor Diamond’s specialized tools.

Logistics. The biggest unknown in this new era is whether PRHPS can ship periodical comics without damage. Both Diamond and Lunar have been shipping comics for decades and have developed packing techniques and packaging that for the most part, gets comics to stores in good shape. PRHPS has a sketchy history with its graphic novel shipments, which I’m told have had a higher damage rate than Diamond or Lunar. While PRHPS has promised improvements when it begins shipping Marvels to comic stores, it remains to be seen whether it can execute. Between the other two, Lunar’s accuracy and packing may be better than Diamond’s right now, and unless things have changed in the last few weeks, Diamond may be third on turnaround on reorders.

Customer Service. Without shipping a book, PRHPS wins this one, because it’s promising dedicated reps for each store. Until Covid, Diamond had dedicated reps, but that broke down as its reps started working from home and there are no signs that’s going to change. Questions and problems go to a queue, and the next rep up handles it. But at least Diamond has reps; few retailers we’ve talked to have ever talked to human being at Lunar on the phone. This is another place where Lunar is handling stores like consumers, and its lack of experience at wholesale shows.

Content is King. The most important variable is whether a given distributor has content that retailers’ customers want to buy. On this variable, PRHPS has the most important content in Marvel, the #1 publisher for comic stores, and Lunar has the second most important content, with DC. Diamond’s line has the most breadth, and it’s also able to offer Marvel, albeit at a higher price. Call this one a draw, for now.

Depending on whether PRHPS can ship comics with competitive damage rates, I put PRHPS at least even with Diamond or perhaps ahead on issues important to retailers. That is going to make it tough for Diamond to hang on to a big share of its business on competitive lines (Marvel now, and IDW and perhaps others in the future). If things head that way, it weakens Diamond’s content position with retailers, and that makes everything else harder. Lunar is going to be fine as long as it continues to be the only source for DC’s, and it can build on that as a base.

So what about qualities important to publishers? How do the distributors rank there?

Financial Strength. In February of 2020, Diamond would have come through on this variable with flying colors. It had touted its strength and stability as key competitive advantages for decades and had built a reputation as a reliable wholesale customer. All that ended in April of 2020, when it announced a lengthy delayed payment schedule for goods received before its shutdown. Publishers had assumed that Diamond would act as the bank for the industry, paying suppliers despite slowing collections. That didn’t happen, and it shook the confidence of Diamond’s suppliers. So PRHPS wins this one easily, as part of a €17 billion international publishing and media conglomerate (Bertelsmann). Lunar is an order of magnitude smaller than Diamond, but appears to be well-run financially.

Works for Publisher Interests. Diamond’s 2020 shutdown hurt it on this variable as well. Its publishers could see that other parts of the business, like the book channel, continued to function in the early Covid period, and wondered why Diamond wasn’t at least trying to ship products that were available to retailers that were open. PRHPS works hard on its publisher client relationships, providing educational events and long-term planning on ways to increase sales, so they score well on this variable. It’s hard to evaluate Lunar on this one, but at least during Covid, it did what DC (and likely other publishers) wanted it to do and continued to ship.

Information Technology. Publishers that switched from Diamond Book to PRHPS described night and day differences between the technology of the two companies, with a decisive win for PRHPS; while the specialized services that Diamond provides to retailers don’t really help it on the publisher side, so we give this win to PRHPS. PRHPS’ superior experience in selling book format products, and in the selling cycle and inventory management for books, also position it well in the fastest growing comic format, a plus for publishers.

Marketing Services. Diamond wins this one. It has been offering events, including its annual Summit and tie-ins with major consumer shows, for many years, which gives publishers another way to connect with retailers and build their sales. Diamond also has a range of other marketing services, tailored to the comic periodical business, that it offers to publishers on an a la carte basis. And it runs Free Comic Book Day, the most important annual promotional event in the business. We’re not seeing anything comparable to most of these offerings from PRHPS or Lunar.

My evaluation is that Diamond is lagging PRHPS in key qualities important to publishers primarily due to the decisions it made during the early Covid period in 2020, and to its longstanding emphasis on systems and programs that support periodicals as opposed to graphic novels, the most important comic format by dollars. Diamond is going to have to rebuild confidence in its financial strength and decision-making, and needs to make major adaptations in how it sells book-format comics to position itself where publishers want to go. Lunar has a base to build from, but needs to expand its services and capabilities to become a major competitor.

You never know when a crisis is going to up-end your business, and the many small decisions that are made every day set the stage for how your company will perform when that crisis comes. I never thought I’d quote Donald Rumsfeld (Secretary of Defense under George W. Bush), but he may have said it best: "You go to war with the army you have, not the army you might want or wish to have at a later time." Now we’ll see whether the decisions Diamond has made over the past 25 years have prepared it for this moment.

We’re still putting these World According to Griepp columns of the Covid era on the public site instead of the Pro site because of the importance of the times, but please support our Pro site with a new or ongoing subscription.

Milton Griepp is the founder and CEO of ICv2, and long-time executive in the geek culture business. The opinions expressed in this column are solely those of the writer.

Diamond Has Had 25 Years to Prepare - Is It Ready?

Posted by Milton Griepp on October 5, 2021 @ 2:11 am CT

MORE COMICS

Part of 1996 Marvel/DC Crossover

August 1, 2025

Writer Karl Kesel and artist Mike Wieringo are the creative team for the one-shot comic, which was first published in 1996 in the middle of a Marvel/DC crossover.

Crowdfunding Campaign Launches in October, Followed by Retail Release

August 1, 2025

Vault will crowdfund the graphic novel on the Backerkit platform in October, then release it to retail.

MORE COLUMNS

Column by Scott Thorne

July 28, 2025

This week, columnist Scott Thorne comments on the Edge of Eternities prerelease and on Magic: The Gathering news from the Hasbro earnings report.

Column by Rob Salkowitz

July 21, 2025

Columnist Rob Salkowitz lays out the Comic-Con panels of interest to industry professionals, current and aspiring creatives, educators, librarians and retailers.