DC’s Executive Vice President of Sales Marketing and Business Development John Rood and Senior Vice President of Sales Bob Wayne spoke to ICv2 on the release of January comic store sales info, in which Marvel narrowly won the #1 dollar share slot; DC won the #1 piece share slot; and DC took the top ten comic slots and five of the top ten graphic novels (see “Comic Store Sales Surge in January”). In the conversation, we talked about the January rankings, graphic novel sales, the health of the business, and digital.

Sweeping the top 10 titles in January is very impressive. About a year ago you did your price rollback to $2.99 (see “DC Lowering Comic Prices in 2011”). How do you think things would be different if you hadn’t changed your prices?

Wayne: We would have had less traction with consumers if we hadn’t changed our prices. One of the factors that is fueling the success is the fact that people can sample the vast majority of our titles for less than the vast majority of our competitors’ titles. If I have to choose between dollars and units, I think units is certainly an interesting one to win at.

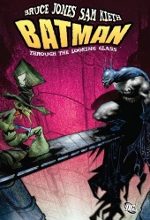

On the graphic novel side, the comic store stop ten was a very different list than the one we received from Nielsenfor bookstores (see “’Sailor Moon’ Is Back on Top”). In bookstores the top DC graphic novel was Batman: The Black Mirror HC and Through the Looking Glass HC, which was #1 in comic stores, didn’t chart there. Is that because the bookstore customer is a different audience or was it a difference in timing in when the books got to those markets?

Wayne: I think it’s a timing difference. I think it may also be that Black Mirror rushed out the door, and we had some supply chain issues for keep it flowing well in both channels. Ultimately I think you’ll see that Black Mirror-- we’re in the process for going back to another printing right now—I think will have a very long tail. We were really happy that Batman: Through the Looking Glass hC was #1 on the Diamond charts in dollars and units in the graphic novel category.

Retailers have been telling us that they felt like their DC graphic novel sales were being impacted by The New 52 in that the collections of pre-New 52 work were not selling as well as they might otherwise. Are you observing that overall?

Wayne: Certainly Batman: The Black Mirror is a pre-New 52 book and it’s performing well in both channels. There are some hard decisions being made by consumers as to what to buy when they’re buying so many more of our periodicals now than they were a year ago. So I think there is some reluctance to buy in on certain things; on the other hand, we still have people sending in topics for conversation for ComicsPro next week wanting to know about this book that we haven’t collected yet or that book that we haven’t collected yet, and they’re all pre-New 52 titles. It depends upon the market and the individual store. I’m not seeing any blanket shifts away from those titles. We had, on that chart, Batman: The Return of Bruce Wayne in trade and Batman: The Dark Knight hardcover collecting the first David Finch batch of stories; those were both in the top 10 on the book chart on the Diamond side, and they’re both clearly stories that were published before the last week of August 2011.

I think that it may be a short-term phenomenon for some stores but I don’t think it’s going to impact the overall performance for our book program going forward.

Rood: And the whole intent is that the collected editions of the New 52 beginning in May more than make up for that alleged underperformance. I’d hate to think anyone has a significant or permanent hang-up with our offerings in light of this one anomaly. And again, come May, let’s expect that everyone is going to make up for any short-term glitch.

We looked back and overall this was the biggest year over year monthly growth (January 2012 vs. January 2011) since May 2006. Your largest competitor is not as strong, so there are some areas of strength and some areas of weakness. How do you feel about the overall health of the retailer base in the comic store market?

Rood: They definitely want to continue seeing The New 52 or "Before Watchmen" or any publishing initiatives on our part as business opportunities for DC Entertainment, but also opportunities to keep retailers vital and keep traffic up. We’ve heard anecdotally from other publishers that it’s lifted all boats. You’ll have to ask other publishers about soft performance, but we want to keep doing all we can to help everyone out.

Do you think retailers are feeling positive going forward right now, or do they still need a little more increase in order to feel more comfortable with the business?

Wayne: I think that as a class of trade, the comic shop retailers are under-capitalized historically, and I don’t think that’s changed during the New 52 initiative. January has always been one of those months when, either we’re rushing to put everything out before the holidays, or people are reluctant to put everything out because they remember how bad the winter was where they happen to be on the East Coast the prior year and people didn’t go outside for a couple of days.

Having a January that’s this strong and a January where we have 10 out of the top 10 on the periodical chart, #1 item on the book chart, really makes us very bullish on January going forward and thinking about January 2013. And we’re certainly happy to help fuel a very strong start to the year for our trading partners.

In The New 52, you’re hitting a period of a lot of change creatively with creative teams changing on a number of books and announcements about getting rid of some titles and bringing in some new ones (see “DC Churns Six Titles”). Is that about the level of change that you anticipated, and will that cause any disruption in this momentum?

Wayne: I don’t think it will cause a disruption in the momentum because we’ve heard great reaction from the field about which titles we’ve replaced with which cancelations. What we’ve been calling “the second wave” has been met with great enthusiasm that’s going to translate into orders. That part is exceeding expectations. Like I mentioned last month, the fact that we are replacing only six titles and only after eight issues, is well exceeding the expectations we had going into this significant undertaking.

There’s a fair amount of concern in the retailer community about the impact of digital. In the past you have said you believe that the digital business is additive to the print business. Anything you want to say to the retailers who are still concerned about the impact of digital on their future business?

Wayne: To a certain extent, the level of success we’re having at physical retail with printed comics certainly shows the people who had the most downbeat assumptions going into The New 52, that all their customers would be buying digital, has not happened by and large since our share has grown and our numbers have grown. I think we’re just finding that yeah, there are some people who used to buy print comics who have migrated, but I think you’ll find there are more people who weren’t buying print comics who come into the habit of reading comics, and I think a lot of those people will eventually come in to buy a collected edition to have on their shelf if there’s something they like and they want to have it in a more permanent physical form. To a certain extent, I have sympathy with anyone who had a big pull and hold customer who [comes in] and said I’m stopping this and I want to switch to digital. I can understand why that would cause a person to stress. It would cause me to stress when I was in retail. But I think on the total size of the market that the growth has been additive and not primarily fueled by cannibalization.

Rood: We also want to get better at encouraging the physical retailers to become digital retailers. We’re committed to working on making as easy as possible for any size physical retailer to start profiting from that additive business of digital.