ICv2 recently spoke with Marvel Publisher Dan Buckley to discuss the market and Marvel’s publishing strategies. In Part 1, we talk about the market, Marvel’s place in it, Marvel’s comic package, and Marvel’s graphic novel strategy. In Part 2, we talked about the changing audience for comics and the transmedia aspect of Marvel’s business. And in Part 3, we talked about Star Wars and Marvel’s publishing plans for its own universe in 2015.

How did Marvel do in 2014 and what is your overview of the market as a whole?

From the standpoint of publishing we had another strong year and we had to cycle against some crazy stuff: some of the tail end of Avengers vs. X-Men and also against Marvel NOW!, which were two very successful things that went back to back pretty cleanly. We ramped into the year very well with consistent publishing programs; it was more multi-character based. Spider-Man had a very strong year; [Brian Michael]Bendis just had a very strong year with the X-books; the Original Sin storyline had a very solid publishing play with it; AXIS had a strong play; Death of Wolverine. Everything just seemed to have a very strong momentum this year.

And then Cap and Guardians having such strong box office performance. We saw a strong performance for Cap coming off the movie; the Guardians performance off the movie was fantastic. I likened it to the cultural event, the kind of reaction we had when The Avengers movie premiered. Guardians products didn’t just jump up for a week or so, they turned into consistent sellers for us in all our forms of distribution which is really exciting to see. It takes pressure off the other franchises and the books that typically have been taking all the pressure for publishing.

That was a surprise to everybody because the perception of Guardians has been as a minor character set, but it really blew up.

The movie felt like a Marvel movie and a different movie at the same time. What we were doing with publishing already with Brian [Michael Bendis] and Steven McNiven, we were reflecting that. Brian, being on the creative committee, had a pretty good insight to what was going on with the movie so he was reflecting that a little bit in the books, even though they’re very different forms of storytelling. And the books we had ready to roll out when the movie rolled out, Skottie Young’s Rocket Raccoon and [Sam] Humphries’ Star Lord, were also able to capture a bit of the tenor of what was going on in that movie.

And on top of that when we did the meeting with Kevin Feige, with Marvel out west,we saw all sorts of interest in the properties that were announced in that slate also: Captain Marvel, Black Panther, Inhumans, all that stuff (see "'Black Panther,' 'Captain Marvel,' 'Inhumans' Movies"). It’s exciting to see publishing continue to have its growth and it’s more exciting to see it happening not just with one hot property. Across the board we’re seeing multiple properties: old standards (Spidey, The Avengers, X-Men), but Guardians is new to the game being a consistent performer. Some of our Marvel NOW! titles really caught wind, Ms. Marvel being notable, a consistent performer in the direct market, book market, and digital distribution.

Marvel had a good year across multiple properties. How much of that do you think reflected market conditions as a whole?

We have such a market share that the market generally moves with us to a certain degree, so sometimes it’s hard to say whether we’re counter or driving it. Looking at the performance of, say, Image, I’d say it was a pretty strong year for the business as a whole. They’re grabbing market share from other publishers I think, but they also saw legitimate growth in their numbers. They have a good calling card with Walking Dead, obviously, but the fact that they have more books performing at a higher level year-over-year is a good indication of a diversified readership, more people trying different things. So I think publishing had a strong year. It’s hard to call it right off of Marvel because generally if you follow the market growth, there’s a pretty good line associated with how Marvel’s performance is.

Any difference in the relative strength between comics, book, digital or mass channels for Marvel?

I think digital is getting more people coming on board, but we’re also seeing people come on board with our print, and the book market had a very strong year.

The overall numbers we see show graphic novels doing very well in 2014.

And compared to our distinguished competition, we’ve only legitimately been in the book market business for a little over a decade now. Under [Publisher Bill] Jemas and [SVP Sales & Marketing] David Gabriel we probably had much more dedication to the book market,moreso than Marvel ever did in the 90s. I think DC was in long before we were.

We saw a really good year in that business, and that’s exciting to see, because when Borders went sideways, you’re wondering what the trend line is out of that and the trend line is that we actually have a stronger business now. People are finding a way to get to their product.

The book market is much more of a mass go-to place to purchase products. With the mass media success of our properties and other graphic fiction properties, the book market is a direct benefactor of that success. The hobby market has seen some of that success too, but this is by far the most consistent mass market presence that our medium has had on multiple platforms. It’s not just movies being released two times a year, but television also had a big influx over the last two or three years. It’s not just us. We’re launching our first couple of shows, The Walking Dead is a phenomenon, and DC’s put more shows on the air, so it elevates the interest in graphic fiction as a whole so therefore it feeds itself. It’s very exciting.

All markets are up for us; the book market is probably the most pleasant surprise.

You talked about specialty retail; is Marvel doing anything with mass merchants?

The mass merchants are much more tied to our major media programs, either movies or the animation. We’re beginning to see some more consistent value purchases there. They’re coming to us saying they’d like to do something (with reprint product mostly), but they’re loading it in, taking it seriously and working with us on how to do it. I’ve been very pleased to have these programs going in and out.

Do we have a consistent presence yet? From a periodical standpoint, no. We’re seeing more consistent placement in the book area, but the challenge there is that the book area is getting smaller in those venues. We’ve been pleased with what we’ve seen, but for us, that’s a more challenging channel because it’s more hit and run.

We’ve heard the concern from retailers that you’re at a 32-page self-cover format for your periodical comic, which is fewer total pages and lighter stock for the cover than some of your competitors. What’s the reasoning behind that strategy?

It’s not a complicated one; it’s financial. I take umbrage at the concept that we deliver less content. It became clear that dedicating 13 to 14 pages of space to an ad sales business that really wasn’t buying 13 to 14 pages of space every month was not an efficient way to produce product. The two most expensive things to produce a comic product are talent and paper. I decided I wanted to invest more money on talent and not on the empty seats of the plane. So we’ve invested more into the talent across the board, made sure we’re delivering a high quality story with high quality art, and I don’t think our choice of paper stock has done anything to harm the delivery of the quality of those stories and what we’re doing, and I would argue that our sales numbers reflect that.

Looking at our sales numbers (that’s what I look at as a litmus [test]),we’ve had a very strong couple years under that format. It’s pretty clear we’ve done a very good job delivering on the stories and providing the talent we need for delivering those stories.

We’ve been doing this a while. The important thing too is that we have not seen a demonstrable uptick in the damages. We’ve always had complaints about damages even with 8-point stock cover with UV coating. I understand people have legitimate concerns; I’m not dismissing those, but our performance and what we’ve done from a financial volume and qualitative standpoint, and what product we’re delivering says we have not made the wrong decision.

We also wanted to ask a strategy question about the graphic novel [collections] side. Marvel blows out leftovers on the poorer-selling graphic novel collections a little faster,you build your backlist a little slower, and treat them a little more like short lifespan products. Can you talk a little about that strategy and the rationale for it?

I’m taking a little umbrage on that one too. I’ll let David Gabriel answer this one in more detail because I don’t live it day to day. I know that the number one complaint that people had with our collection program when I first came back 11 years ago was this very point. We had a horrible management of our backlist. I think a lot of guys hold on to that, but it’s simply not true. I’m not going to say that of some of our lower selling titles we don’t have a deep backlist; that is very true. But books that sell,we have available. Many guys just don’t check, they don’t think we have it.

I know we’ve been much more aggressive managing our backlist, particularly on the top selling books or the books that we think will become top selling books. On the lower selling books, yeah, we’re tighter on our inventory because the thing that can kill you in this industryis inventory. A lot of people have made mistakes in that area, saying, "My per unit cost is going to be a lot lower if I print 50,000 units." But if you only sell 10,000 of them, that’s a waste of a lot of money. The guy who wants to order onesie-twosies on the backlist can get them, but it’s going to take 12 years to get rid of 20,000 copies.

On the lower selling books, we do run a much tighter backlist program, because financially, it’s just not viable to hold the deep inventory on something that may only get 100 reorders. Every client is important, and I‘m not trying to dismiss the concern, but I also think that a lot of people just go to that immediately, and I can say with utmost confidence we have the strongest backlist inventory of our top selling books and top franchise books that we’ve ever had.

Marvel SVP Sales and Marketing David Gabriel provided this additional answer via e-mail:

"It’s an old misconception that Marvel does not have a strong backlist. That may have been true about 10 years ago, but in the modern day it’s quite strong. Titles like Civil War, Secret Wars, Infinity Gauntlet, Captain America: The Winter Soldier, anything Deadpool or Guardians of the Galaxy and too many X-titles to mention ranging from Death of Phoenix, Days of Future Past, Age of Apocalypse, etc. The list goes on and on.

We’ve even created new continual best sellers like Hawkeye, Ms. Marvel, Magneto, Moon Knight and other titles from the Marvel NOW launches. It’s been years since we’ve had issues of any best-selling titles being out of stock for any extended period of time. Also, our book and mass market sales are the strongest they’ve been in years. And if you take a look at the sales charts in the Direct Market you’ll also see some of the titles mentioned here."

Click here for Part 2.

The Market, Marvel's Comic Package and Graphic Novel Strategies

Posted by ICv2 on January 19, 2015 @ 4:22 am CT

MORE COMICS

YouTuber's Self-Published First Volume Sold 200,000 Copies DTC

August 11, 2025

The self-published edition of the first volume of the YouTuber’s graphic novel sold over 200,000 copies direct to consumers when it was released in 2024.

Showbiz Round-Up

August 11, 2025

The summer heat is on, and Hollywood news is boiling over. Time for a round-up!

MORE NEWS

New Tank Battle Board Game by Smirk & Dagger

August 11, 2025

Smirk & Dagger will release Boom Patrol, a new tank battle board game, into retail.

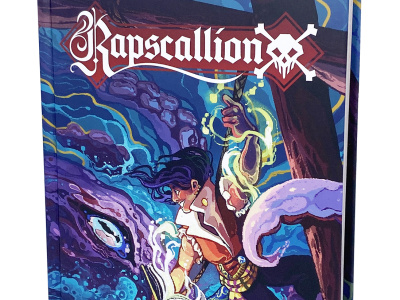

New Weird Swashbuckling RPG

August 11, 2025

Magpie Games will release Rapscallion, a new weird swashbuckling RPG, into retail.