Last week, Amazon shocked the market and delivered a firm knee to the groin of its competitors by acquiring national grocery chain Whole Foods Market for $13.7 billion (see “Amazon Stops Pretending It Doesn’t Want It All”). As ICv2 noted in its analysis of the transaction, the move represents the clearest evidence yet that Amazon is expanding beyond its ambitions to dominate the e-commerce world and literally wants to sell everything to everyone everywhere. This has escalated the competition between Amazon and the dominant retailer here in meatworld, Walmart (see “Amazon and Wallmart Now in All-Out War”), in perhaps the biggest abnegation of a truce between unsavory combatants since Operation Barbarossa.

Attack of the 500-foot Amazon. Analysts here and elsewhere have pointed out many of the features of the Whole Foods deal: the fact that it gives Amazon an instant national footprint in terms of retail real estate, a point of distribution for its burgeoning grocery delivery business, and an opportunity to blend digital and physical commerce in unprecedented ways. The Whole Foods markets are also a giant petri dish where Amazon can try out different approaches to data-driven merchandising and customer targeting, as it’s been doing in its bookstores.

Over at Vox, Matt Yglesias sees the Whole Foods acquisition as bad news for the entire grocery business because, in his formulation, Amazon does not compete on the same basis as everyone else. That is, they do not look to profit from operations or generate piles of cash to redistribute to shareholders, and their shareholders are ok with this. That gives them a huge advantage over just about every other company that seeks short or even medium-term profits and can’t afford to plow every penny of revenues into new market growth.

It’s the customer, stupid! All this may be true. But there’s one other aspect of the Whole Foods acquisition that seems notable to me. Consider this: For what it was willing to pay, Amazon could have had almost any grocery retailer except for Wal-Mart, Target or Costco. Leading nationwide chain Kroger, for example, has a total market capitalization of around $20 billion; #2 Albertson’s (which owns Safeway, Acme and other brands nationwide), currently privately held, has had an IPO in the works to raise $1.8-$2 billion, which suggests $14 billion could have bought them twice or three times over.

So why Whole Foods?

If you have a Whole Foods Market in your community, chances are you’ve heard it referred to as “Whole Paycheck” because of its niche charging top dollar for luxury brands and organic items. That reputation would seem to put it at odds with Amazon, which relentlessly seeks lower prices for customers, sometimes at the expense of suppliers and always at the expense of maximizing its own profits.

But here’s the thing: a high-priced brand reputation attracts affluent shoppers. It attracts the kind of people willing to spend extra for the perception of higher quality merchandise, as well as for the intangible benefits of a brand that makes a big show of supporting organic, sustainable, local, fair-trade, yadda yadda, which all reinforce the consumer’s virtuous self-image.

To reiterate: The stereotypical Whole Foods customer is selective, highly aware of issues related to the source of the products they are buying, and deeply invested in the relationship between their consumption habits and their personal identity.

Does that sound familiar, geek-culture retailers?

Cleanup on aisle Prime. Amazon’s interest in this demographic seems self-evident. Whole Foods shoppers are exactly the kind of people Amazon wants to increase its Amazon Prime footprint. Amazon Prime is the crack pipe that makes it ridiculously easy and friction-free to order everything from Amazon and have it delivered to your house free in days or even hours.

Amazon is building out the capabilities of this system with Dash, the buttons that automate reorder of household items, and of course Amazon Echo, which turns its Alexa AI into a member of the family, always listening for ways to be helpful in ordering more stuff from the mothership.

But Amazon Prime costs extra. That means Amazon needs consumers with a little bit of disposable income and a proven willingness to spend extra in order to be pampered. Whole Paycheck has years of customer data on this segment to marry with Amazon’s own storehouse of knowledge. Before long, they will know these shoppers better than they know their own children.

Learn from the best, learn from the Beast. Amazon is a fearsome competitor and a problematic partner if you are small and in the way, but they really understand how to please their customers. The Whole Foods acquisition shows that they perceive an opportunity with picky shoppers at the high end of the market, one worth a $14 billion investment in the complex, low margin grocery business just to gain a foothold.

Small businesses may not be able to match Amazon’s selection or pricing power, but they can compete for these kinds of customers on the basis of a well-curated inventory, well-branded retail environment, and personalized service. It’s also the case that publishers and developers who understand their customers well have something that Amazon wants and needs. It’s worth taking a moment while you are in your bunkers counting down to Retail Doomsday to take stock of your assets and advantages. Amazon certainly has.

The opinions expressed in this column are solely those of the writer, and do not necessarily reflect the views of the editorial staff of ICv2.com.

Rob Salkowitz (@robsalk) is the author of Comic-Con and the Business of Pop Culture.

Column by Rob Salkowitz

Posted by Rob Salkowitz on June 26, 2017 @ 2:28 pm CT

MORE COMICS

After Our First 24 Years

July 9, 2025

ICv2 has a new address after occupying offices in Madison, Wisconsin for its first 24 years.

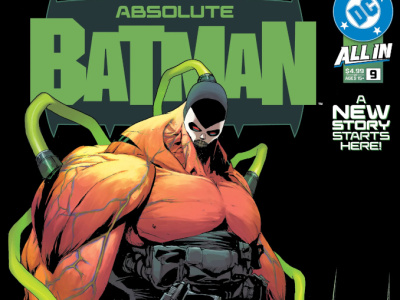

Sales Rankings Based on Comic Store POS Data

July 8, 2025

These are unit and dollar sales rankings based on sales tracked at point-of-sale by the ComicHub system at stores selling American comics around the world.

MORE NEWS

Headed for Retail

July 8, 2025

Atomic Mass Games revealed five new Star Wars: Shatterpoint miniatures packs for release into retail

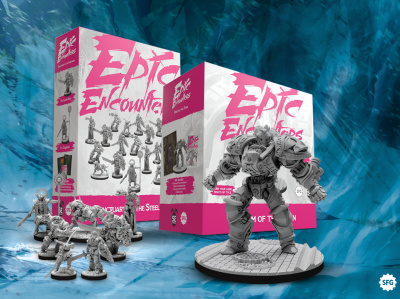

'Sanctuary of the Steelborn' and 'The Titan's Vigil'

July 8, 2025

Steamforged Games has placed Sanctuary of the Steelborn and The Titan's Vigil, two new Epic Encounters sets, onto preorder.