Sales in Hasbro’s total gaming category were down 19% in Q2, the company said in its second quarter earnings report, released today. Sales in the category were $319.0 million for the quarter, down from $393.4 million in Q2 2019. Those sales include franchise brands Monopoly and Magic: The Gathering; sales in the Hasbro Gaming portfolio, which do not include those franchise brands, were up 11%, from $123.4 million in Q2 2019 to $137.0 million in Q2 2020.

Sales of Magic: The Gathering were down substantially in the quarter, due to tough comps and the move of Ikoria: Lair of the Behemoths from Q2 to Q1 to beat manufacturing and shipping shutdowns (see “Hasbro’s Total Gaming Business up 40% in Q1”). The half-year total gaming category, including Magic and Monopoly was up 4%.

What was selling in Q2 were the kinds of games Hasbro sells at mass merchants and online; global POS sales (reported by chains and online retailers) of the Hasbro Gaming portfolio, which doesn’t include Magic and Monopoly, were up 50%, with Jenga, Connect 4, Battleship, Mousetrap, and Twister providing the biggest sales increases, according to the report. U.S. sales tracked above that global percentage, with POS sales of Hasbro Gaming up 70% for the period.

Hasbro CEO Brian Goldner did report some positive news on the Magic: The Gathering front in the conference call, revealing that the Ikoria set was the bestselling spring set in the history of the brand, and that the number of WPN stores was up by double digits in the quarter.

Hasbro’s overall sales were down 29% in the quarter, to $860.3 million vs. (pro-forma) revenues of $1.2 billion in Q2 2019. The company lost $33.9 million, vs. (pro-forma) net losses of $42.6 million in Q2 2019.

COVID impacts were evident throughout the report, not only in the big increase in family games. Hasbro estimated that 30% of its global toy and game revenue was transacted online in Q2, a big jump over the normal percentage. Its supply chain from China improved, with Chinese factories catching up after their Q1 shutdowns, while factories in Ireland and the U.S. fell behind after two-month shutdowns. Production in those factories is not expected to catch up until late in Q3, assuming no more shutdowns.

The shutdown of the theatrical business hurt Hasbro’s sales of licensed products, with the moves of many movie releases to which products were tied to later in the year or 2021, and the move of Trolls to streaming release from theatrical.

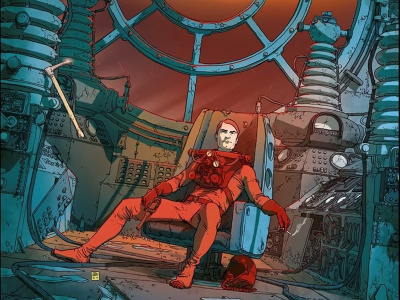

Goldner did draw attention to Hasbro’s direct-to-consumer release of the $349.99 X-Men Legends Marvel’s Sentinel, of which Hasbro has sold 11,700, with 28 days left in the campaign.