A federal bankruptcy judge has ruled that a lawsuit against former Toys 'R' Us executives and directors, including partners of private equity firms Bain Capital, KKR, and Vornado Realty Trust can proceed. The ruling last week in bankruptcy court in Virginia allows the case to proceed on two claims: that the company spent $600 million buying product and services after filing for bankruptcy without disclosing that a shutdown was likely; and that advisory fees and management bonuses paid to private equity firms between 2014 and 2017 should not have been paid because the company was already insolvent.

The creditor lawsuit also alleges that bonuses paid to Toys 'R' Us executives just prior to the 2017 bankruptcy filing were a violation of the executives’ fiduciary duty.

The Toys 'R' Us was exceptionally messy, and closed the chain's 800 U.S. stores with little warning (see "Toys ‘R’ Us closing All Stores"). The shutdown was primarily due to debt laid on the company by its private equity owners, which led to insolvency despite operating profits. After a Chapter 11 filing (see "Toys ‘R’ Us Files Chapter 11"), creditors decided they could make more money by forcing a liquidation than through a restructuring that would keep the company alive.

Can Proceed

Posted by Milton Griepp on July 8, 2022 @ 2:17 am CT

MORE GAMES

In 'Dracula vs. Hitler'; New RPG Just Unveiled by Devir Games

August 1, 2025

Devir Games unveiled Dracula vs. Hitler , a new RPG, that will be heading to BackerKit.

For 'Cosmere RPG'

August 1, 2025

Brotherwise Games previewed their Stormlight Premium Miniatures Collection , for Cosmere RPG .

MORE NEWS

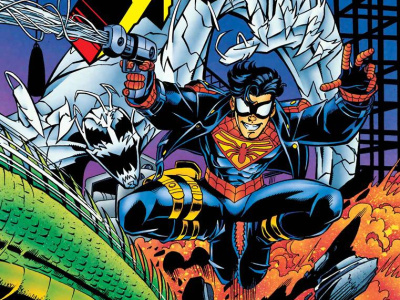

Part of 1996 Marvel/DC Crossover

August 1, 2025

Writer Karl Kesel and artist Mike Wieringo are the creative team for the one-shot comic, which was first published in 1996 in the middle of a Marvel/DC crossover.

Crowdfunding Campaign Launches in October, Followed by Retail Release

August 1, 2025

Vault will crowdfund the graphic novel on the Backerkit platform in October, then release it to retail.