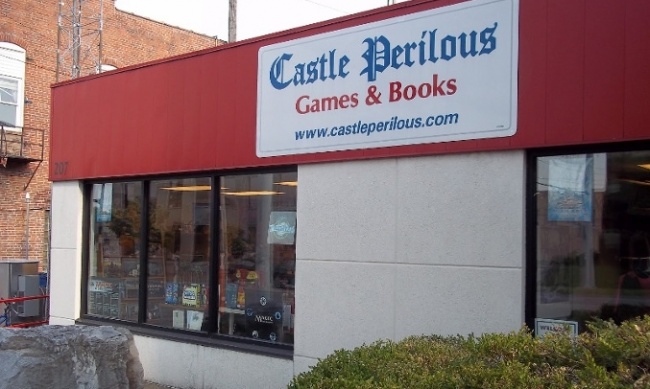

Rolling for Initiative is a weekly column by Scott Thorne, PhD, owner of Castle Perilous Games & Books in Carbondale, Illinois and instructor in marketing at Southeast Missouri State University. This week, Thorne looks at a tax proposal and how it would impact the hobby games business.

I caught a story on NPR’s Morning Edition last Friday that will have quite an impact on the game industry should it come to pass. It is called the destination-based cash flow tax or, as President Trump and some of his advisers have called it, the Border Adjustment Tax. How does this affect gaming? Let me explain as best I can, given that I am neither a lawyer nor an accountant.

Manufacturing a product outside of the U.S. is far cheaper, generally due to labor costs but also to economies of scale, than making it in this country. Mayfair Games, Looney Labs, and Skybound Games are notable exceptions that print in the U.S., as are Wizards of the Coast’s Dungeons & Dragons books. I am sure there are others as well that I missed; those are the ones that come to mind. However, games like Exploding Kittens, Cards Against Humanity and almost everything Fantasy Flight Games produces gets printed in China, dropping the cost of goods dramatically and allowing to keep the price on their games reasonable while still making a profit. As I have discussed before, game stores, game distributors and game publishers all need to make a profit to stay in business.

Most businesses incorporate to operate under a corporate shield. Small ones, like many in the game industry, operate as Limited Liability or Subchapter-S corporations, giving them a lower tax rate than regular corporations which pay a top tax rate of 35%, often reduced because of various shelters and shields. In order to avoid paying the 35% tax rate, a number of corporations shield their profits by keeping them overseas in more tax friendly countries, reducing the tax paid but also keeping them from investing them here in the U.S.

In order to encourage companies to move their profits back to the U.S., as well as moving manufacturing back in country as well, the federal government is considering some significant corporate tax reform. One thing under consideration is reducing the corporate tax rate to 20%, encouraging companies to repatriate their overseas profits. Another thing, which would certainly impact the game industry, is the under consideration Border Adjustment Tax. This is a tax designed to discourage companies from manufacturing products in other countries and importing them to sell here in the US. If a corporation sells in the U.S., one of the largest markets in the world, it would pay the BAT on those profits. If a U.S. company sells outside the U.S., no tax is collected on the profits generated. Ideally, this encourages companies to export more from the US and discourages imports. Given the number of gaming companies that import their products, we would likely see either a shift of game manufacturing back to the U.S. or a significant jump in prices.

If this moves anywhere in Congress, you could expect large retail chains such as Best Buy and Walmart to lobby extensively against it, due to the amount of merchandise the companies import. There’s a good chance it might run into difficulty in the World Trade Organization as well, which is why any tax reform we see will be a lengthy and very complicated undertaking, no matter how simple it might seem in theory.

The opinions expressed in this column are solely those of the writer, and do not necessarily reflect the views of the editorial staff of ICv2.com.

Column by Scott Thorne

Posted by Scott Thorne on February 13, 2017 @ 12:47 am CT

MORE GAMES

'A Villainous Halloween' In-Store Event

August 15, 2025

Wizards of the Coast announced A Villainous Halloween , a new Magic: The Gathering Commander in-store WPN event.

Base Game, Expansions, Accessories

August 15, 2025

Asmodee will release The Witcher: Path of Destiny core game, expansions, and accessory pack.

MORE COLUMNS

Column by Scott Thorne

August 11, 2025

This week, columnist Scott Thorne notes a new twist in the Diamond Comic Distributors saga and shares his thoughts on the Gen Con releases that will make the biggest impacts.

Column by Jeffrey Dohm-Sanchez

August 7, 2025

ICv2 Managing Editor Jeffrey Dohm-Sanchez lays out the hotness of Gen Con 2025.