Disney’s shocking announcement with last week’s earnings report that it was shutting down Disney Infinity (see “Disney Shutting Down ‘Disney Infinity,’ Takes $147 Million Charge”), its Collectible Miniatures Game/video game hybrid (toys-to-life, in industry parlance) was hard to understand, given the high sales reported for the line and the popularity of the underlying characters. But statements by Disney CEO Robert Iger in the conference call following the release of the report, and info on the overall market for the category, may show what happened.

The inventory build-up that led to most of the $147 million write-down was fairly recent, according to Iger, and was tied to the release of Disney Infinity 3.0 last year. “[W]e did quite well with the first iteration of it,” Iger said in the conference call (transcript via Seeking Alpha). “And we did ok with the second iteration, but that business is a changing business, and we did not have enough confidence in the business in terms of it being stable enough to stay in it from a self-publishing perspective.”

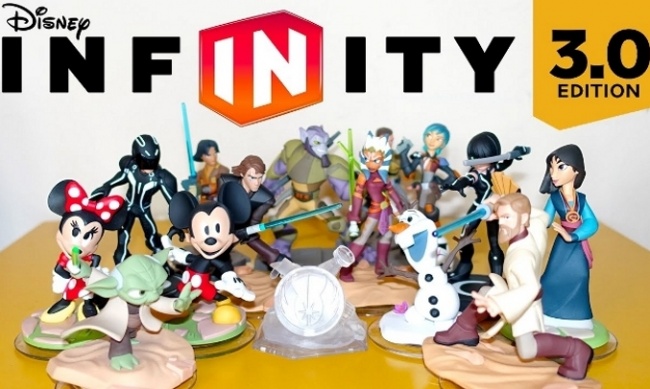

The first iteration Iger speaks of was the launch configuration in 2013, which included characters from Disney and Pixar movies. The second iteration was the addition of Marvel (along with new products tied to the Disney/Pixar line) in 2014. And last year, Disney added Star Wars to the mix, with an additional Force Awakens release tied to the movie premiere, along with new products tied to the Disney/Pixar and Marvel lines. It was this range of 2015 releases that apparently caused the problems.

But why? If the Disney/Pixar and Marvel lines were doing well and then you add Star Wars in the biggest year ever for the property, shouldn’t that be like printing money? Apparently not, and the problem may have been that the market is not growing as fast as the increase in the number of products.

The toys-to-life category grew 7% in the U.S. last year to $720.5 million, according to NPD figures reported by the Wall Street Journal. Sales in the category worldwide were $1.25 billion in 2015, flat vs. 2014, according to a Wedbush Securities analyst quoted in the report.

But in addition to Disney throwing a new line into the category in 2015, Warner Bros. launched Lego Dimensions, with characters from fourteen franchises (including Lord of the Rings, DC, The Simpsons, Doctor Who, Ghostbusters, and Jurassic World) last fall, and Nintendo continues to produce its Amiibo line and Activision its Skylanders line.

So with a flat or near-flat market and rapidly increasing numbers of releases last fall, something had to give and Disney ended up with a big pile of inventory.

No tree grows to the sky, as the saying goes, and the toys-to-life category appears to have hit an upper limit. It’s still a great market, but not the kind of category in which Disney wants to operate on its own. Hence the decision to license to other companies in the category instead of producing games itself.

“[W]e just feel that it’s a changing space and that we’re just better off at managing the risk that that business delivers by licensing instead of publishing,” Iger said. “It’s just that simple.”

Disney will release final Disney Infinity products with figures from Alice Through the Looking Glass and Finding Dory.