Comcast submitted a $65 billion all-cash offer for the Fox movie and television assets Disney is in the process of acquiring, topping Disney’s bid of $52.4 billion in stock. The move was made in the wake of the Tuesday ruling against the Department of Justice, which had sued to block the AT&T acquisition of Time Warner (see "Judge Rules Against DOJ: AT&T Will Acquire Time Warner (and DC)"). With the judge heartily rejecting the government’s arguments, Comcast felt freed from much of the regulatory risk in a similar vertical (distribution buying content) deal.

The hefty premium over the Disney offer will undoubtedly bring a serious look from Fox’s board, who will likely give Disney a chance to counter. The Comcast offer came in higher than some expected, increasing the pressure on Disney to raise its bid substantially (see "Comcast Publicly Commits to Bidding on Fox Assets").

The Fox board will have to consider the difference between receiving cash and receiving Disney stock as well as the price difference. Disney would receive a breakup fee of $1.52 billion from Fox if their deal doesn’t close, a factor that slightly lowers the effective difference between the two offers.

Will Disney Counter?

Posted by Milton Griepp on June 14, 2018 @ 3:43 am CT

MORE COMICS

Crowdfunding Campaign Launches in October, Followed by Retail Release

August 1, 2025

Vault will crowdfund the graphic novel on the Backerkit platform in October, then release it to retail.

With New Movie and Two Comics Treatments

August 1, 2025

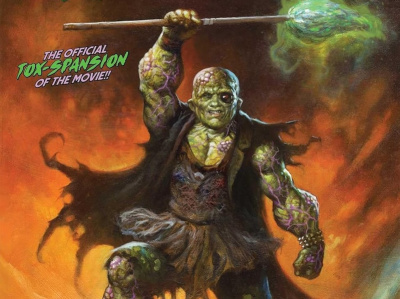

With a movie premiering in August, a graphic novel anthology, and a new ongoing series, the Toxic Avenger is hot!

MORE NEWS

In 'Dracula vs. Hitler'; New RPG Just Unveiled by Devir Games

August 1, 2025

Devir Games unveiled Dracula vs. Hitler , a new RPG, that will be heading to BackerKit.

For 'Cosmere RPG'

August 1, 2025

Brotherwise Games previewed their Stormlight Premium Miniatures Collection , for Cosmere RPG .