Rolling for Initiative is a weekly column by Scott Thorne, PhD, owner of Castle Perilous Games & Books in Carbondale, Illinois and instructor in marketing at Southeast Missouri State University. This week, Thorne points out some highlights of the Fall issue of Internal Correspondence, focusing on the hobby game sales numbers (see "Hobby Game Sales Total $1.5 Billion in 2018" for a summery, and on the Pro site, the full article "Pro: Hobby Game Sales Total $1.495 Billion In 2018 - In Depth").

ICV2 sent out the Fall issue of Internal Correspondence a week or so ago with its annual look at industry figures. Unfortunately, Wizards of the Coast also dropped information at San Diego Comic-Con on the new Magic pack formats releasing with Throne of Eldraine, so as I noted in last week’s column, a new column got written very quickly (see "Rolling for Initiative: Booster Fun With 'Magic: The Gathering' 'Throne of Eldraine'"). In case you are not familiar with Internal Correspondence, it is ICv2’s bi-annual magazine that explains the business of the game and comics industries. The analysis appears in Internal Correspondence, issues of which are sent free twice a year by mail and in distributor shipments. Since this is the best publicly available analysis of the gaming Industry, in my experience, I've always read it over a couple of times. I find it handy to have the columns and analysis gathered under one cover, rather than hunting down individual articles on the website.

Here are some of the interesting points in the fall analysis:

Definition of "hobby games." I'm still not thrilled with using the term "hobby game" as a descriptor for the type of games most board game stores stock, but it seems it's the best one we currently have. About twenty years ago, the accepted term was Eurogame or Euro-style game, but as more American publishing houses released games more reliant on strategy than the luck of a dice roll, that term fell out of favor. (We did have a customer trading in some boardgames last week that referred to his collection of "Eurostyle" and "Ameritrash" games.) ICv2 defines "hobby games" as games produced for the "gamer" market as well as games primarily, although not solely, sold through tabletop game stores.

Sales Down Slightly. ICv2 collects data from "interviews with key industry figures with good visibility to sales in various categories and channels." It also collects data from publicly traded companies, data from NPD, and data primarily from ICO Partners regarding Kickstarter campaigns. According to the data collected, industry sales dropped about 3%, primarily due to a 14% drop in the TCG segment caused by the cooling off of Pokémon after the huge bump driven by Pokémon Go in 2017. Boardgames and non-collectable miniatures increased single-digit levels, as did board games (which had shown low double-digit increases for the past five years). Card and dice games stayed flat while roleplaying games increased 18%, still overwhelmingly driven by sales of Dungeons & Dragons. However, at less than 10% of the overall market, RPG sales account for a fraction of the amount generated by trading card games or even miniatures games.

Kickstarter Growth. Games funded by Kickstarter campaigns were up 20% in 2018, growing for the fouth year in a row. Since Kickstarter launched, over 20,000 game projects have sought funding on the platform, with an additional number seeking funding on Indiegogo and other platforms (see "Tabletop Game Kickstarters Still Growing"). Given that 37% of the games seeking funding on crowdfunding platforms fail, that is still a lot of games heading to the market. While the funded ones obviously have demand from their backers, it is a crap shoot for publishers as to whether they should produce enough of a crowdfunded game to have copies to put into distribution.

Looking forward, I expect to see double-digit growth in TCGs, propelled by the popularity of Magic: The Gathering Ravnica Allegiance and War of the Spark, single-digit growth in board, dice and card games, and double-digit growth in RPGs and non-collectable miniatures, driven by the myriad Twitch streams, YouTube channels and TV series. We’ll see if I'm right next year.

The opinions expressed in this column are solely those of the writer, and do not necessarily reflect the views of the editorial staff of ICv2.com.

Column by Scott Thorne

Posted by Scott Thorne on July 28, 2019 @ 10:47 pm CT

MORE GAMES

New Tank Battle Board Game by Smirk & Dagger

August 11, 2025

Smirk & Dagger will release Boom Patrol , a new tank battle board game, into retail.

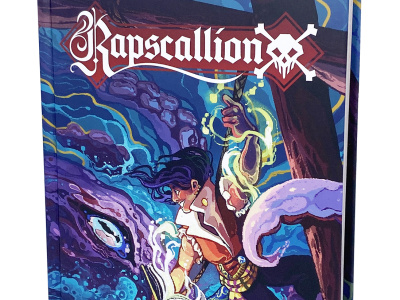

New Weird Swashbuckling RPG

August 11, 2025

Magpie Games will release Rapscallion, a new weird swashbuckling RPG, into retail.

MORE COLUMNS

Column by Scott Thorne

August 11, 2025

This week, columnist Scott Thorne notes a new twist in the Diamond Comic Distributors saga and shares his thoughts on the Gen Con releases that will make the biggest impacts.

Column by Jeffrey Dohm-Sanchez

August 7, 2025

ICv2 Managing Editor Jeffrey Dohm-Sanchez lays out the hotness of Gen Con 2025.