An ICv2 Release. The comics and graphic novel market slipped 6.5% in 2017, with sharper declines in comic store and newsstand sales mitigated by stronger sales in the book channel and digital, according to a new joint estimate by ICv2’s Milton Griepp and Comichron’s John Jackson Miller. Total comics and graphic novel sales to consumers in the U.S. and Canada remained above $1 billion at $1.015 billion in 2017, a $70 million decrease from sales in 2016.

"After a multiyear growth run, the comics shop market gave back some of its gains in 2017, with lackluster response to new periodical offerings and, consequently, graphic novel sales," Miller said. "The third quarter of 2017 saw the worst of the year-over-year declines, leading into what has turned out to be a stronger spring for stores in 2018."

"While there was some softness to the market in 2017 (which we attribute to cyclical rather than secular change), there were positive signs," Griepp said. "The relative strength in the graphic novel and digital markets, especially the growing market for kids titles across print channels, bodes well for the future."

Digital sales were flat, the strongest performance of any channel in 2017. The book channel (mass and specialty retail chains, online, independent bookstores, book fairs) was the strongest print channel, with only about a 1% decline, helped by booming sales of kids’ graphic novels. The comic store channel, the largest channel overall, dropped around 10%, while the smallest channel, newsstand, shrank to a size not seen since the dawn of comics as the last remaining DC comics left newsstands in August.

As presented above and in the accompanying infographics, the analysis by Comichron and ICv2 was divided up between periodical comics (what some call "floppies" or "pamphlets"), graphic novels, and digital download-to-own sales. All print figures are calculated based on the full retail price of books sold into the market, and do not account for discounting or markup. Digital sales do not include subscription or "all you can read" services.

This is the fifth joint market size analysis from ICv2 and Comichron; the first was for 2013 sales.

See also, "ICv2 Releases 'Internal Correspondence' #94"

Click on the Gallery below to see the Comic Sales Report graphs for 2017.

ICv2

ICv2 is the #1 industry source on the business of geek culture, including comics and graphic novels, hobby games, and showbiz on its website, www.ICv2.com, and in its magazine, Internal Correspondence. For the people on the front lines of the geek culture business, staying ahead of the trends isn't something that can be left to chance-it's a basic necessity for being successful. That's why ICv2 is the #1 source of news and information for the buyers, gatekeepers, and tastemakers on the front lines. ICv2 is where trend-watching is a science.

Comichron

Comichron is the world's largest public repository of comic-book sales figures, featuring data from the 1930s to today about comic book and graphic novel circulation, cover prices, and market shares on its website, www.comichron.com. With data and analysis on the distant past as well as the present, Comichron serves as a trusted resource for academics studying the historical reach of the medium and for collectors seeking accurate information about how many copies of a comic book originally circulated.

According to New Estimate by ICv2 and Comichron

Posted by Milton Griepp on July 13, 2018 @ 6:21 am CT

MORE COMICS

Publisher Founded by Former Heavy Metal CEO to Expand with Three Imprints

August 15, 2025

The publisher, founded by former Heavy Metal CEO Michael Medney, will expand with three new imprints.

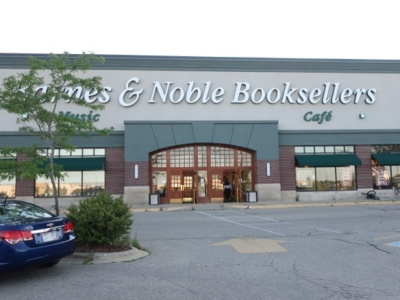

Madison, Wisconsin on August 10, 2025

August 15, 2025

We visited the large Barnes & Noble store in Madison, Wisconsin on a Sunday afternoon, and found manga and merch displays expanded.

MORE NEWS

'A Villainous Halloween' In-Store Event

August 15, 2025

Wizards of the Coast announced A Villainous Halloween , a new Magic: The Gathering Commander in-store WPN event.

Base Game, Expansions, Accessories

August 15, 2025

Asmodee will release The Witcher: Path of Destiny core game, expansions, and accessory pack.

View Gallery: 4 Images

View Gallery: 4 Images