We recently interviewed BOOM! Studios President of Publishing and Marketing Filip Sablik to get his views on the market and BOOM!’s place in it. In Part 1, we talked about market conditions, why BOOM! is with Diamond, direct-to-consumer sales, and channel mix. In Part 2, we talked about BOOM!’s publishing profile and plans for the year, including BOOM! Box, their new Jeff Lemire ongoing, ongoing series in general, variants, and top 2024 releases.

ICv2: Let's start out with big picture stuff, and start with the medium as opposed to the market. How do you evaluate the current state of the comics medium?

That's a great question. I think the medium is as strong, if not stronger than it's ever been. If I look at the breadth of content and the type of content and we pull out beyond what we typically tend to focus on in North America, which would be the direct market; if you look at digital and print publishing across all the different sales channels, I really do think there's something for everyone, in a true sense, which is exciting.

As somebody who loves the storytelling medium more than the actual vehicle by which we get the stories to people, it's exciting. Anecdotally (I'm sure you've had this conversation with other folks who have kids that are growing up, I've got a 12‑ and a 10‑year‑old), for them, there's no stigma attached to comic books as a medium, which is an amazing thing to think about, how far that's come in the last 20 years, let alone the last 50, 75 years.

Let's talk about the market then. You said you're focused on the direct market. What do you evaluate as the condition of the direct market?

Everyone at all levels of the market is reckoning with the fact that we are now in the stage where we're dealing with aftershocks of the pandemic era. We're returning to something that more closely resembles a pre‑pandemic marketplace.

My read of it is that, in general, the market seems to be returning to something that resembles 2019 more closely than 2020 through 2022. We're seeing that in our business.

We had the good fortune that the pandemic era was really an era of growth for us. We’ve certainly come down from the peak in 2021, which would have been where BOOM! peaked, but we’re still well above 2019. I think the thing that we have to balance that with is that the difference between 2019 and 2024 is just the complexity, the fracturing of distribution, the complexity that has been added to virtually every layer of bringing product to market.

I think that's where, if I'm seeing pain points, it's in the amount of effort or work that's having to go in to generate similar results.

You're still exclusive at Diamond [Comic Distributors], correct?

For the direct market, yes, and Simon & Schuster for the book market.

You and Dynamite Entertainment are the last two are what we used to think of as the big seven who were with Diamond in January of 2020. To still be with Diamond as an exclusive distributor, what are you seeing that's different from what the five that left saw?

I don't know that it's so much what we're seeing that's different, because we certainly saw, I suspect, similar opportunity that other publishers may have seen with potentially moving business to PRH [Penguin Random House Publisher Services], moving business to Lunar [Distribution]. Anytime there's competition, you’re going to have opportunity.

Part of what we weighed was the long‑term impact of everybody shifting their business around, and doing what was in their best interest in the near term. We felt like we had a really good relationship, to begin with, with Diamond and that they were really interested in working with us to make sure that they were supporting us in the way that we needed them to. We felt that in the long term, a healthy direct market included a healthy and strong Diamond, so we wanted to support them in return.

For this year, we were really excited to see that they were able to address some of the freight issues that they were having with retailers, in terms of the costs for retailers. I think that was one of the biggest pain points as their volume got reduced and costs increased. That definitely had an impact. That's been in effect for 11 days now. Anecdotally, we've gotten positive feedback from retailers, and early signs in terms of ordering over the last couple weeks seem to suggest that that is something that retailers are responding to positively and voting with their dollars, but obviously, it's very early going.

Let's talk about the book market a little bit. What are the conditions in the book channel from your perspective?

Heading into the pandemic, what we saw was that a lot of the major buyers in the book market, in order to be competitive with Amazon, were shifting the inventory pressure back on the publishers.

Previously, you would see chain retail, and even wholesalers, take a deeper position on inventory, so that they had copies immediately available for reorder. We saw them shifting more to an Amazon model, where instead of maybe a quarter worth of inventory, they were trying to carry six to eight weeks.

Then there was almost a whiplash, as during the pandemic we had supply chain issues, so if you didn't order the inventory up front, it might not be there. Now we're starting to see that correct again. The gross numbers are probably down the heights of where they were either at the pandemic or pre‑pandemic. Simon (their sales team) has done a really terrific job of managing that sell-in and sell-through, so our returns are down pretty significantly as well. On a net basis, it’s allowed us to manage the business really effectively and responsibly. Obviously, there are moments where you wish somebody would take a deeper position on a project you're particularly excited about, but overall, it's still trending in a positive direction for us.

We’re interested in your direct-to-consumer business. That appears to be area of growing emphasis of the last few years for BOOM! It seems like you're going hard, maybe harder than some other publishers, at direct-to-consumer. Why are you going that way?

I'll maybe challenge the core assumption there. If you look at other publishers at our level, there are a number of other publishers that are running campaigns maybe as frequently as we are. We might be more visible, because I think on the average, we're finding greater success.

Who besides Dynamite?

Oni has certainly stepped up, which shouldn't surprise you, because Hunter helped me develop BOOM! Direct Reserve here at BOOM!, so he certainly knows the opportunity there. From what I've observed, other publishers are now beginning to dip their toes, and even larger license holders are much more open to that.

I saw just today that McFarlane Toys is going to be doing a Batman-Spawn statue that's going to go through Kickstarter first. If you'd told me that I'd be seeing Batman on that platform in that way, I would have been a little bit surprised a year ago.

To answer your question, we think that channel is additive. Typically, the projects that we try to debut or run through that channel are properties or projects that we believe there is a meaningful audience outside of the direct market, outside of the book market, and that we can bridge the gap with a call to action. With one click, you are now set and you're going to get the content.

We're trying to widen the sales funnel essentially, and bring those people in, add them to our mailing list. For example, on something like BRZKR or The Expanse, we've been able to take those campaigns, which cover 12 issues worth of publishing, and essentially for 18 to 24 months, every single month, we are communicating and engaging with that community, and educating them on what else is available for those properties in comic shops or in the book market. That's something that we're actively doing.

Over time, our hope is that we are exposing that audience that would have been much harder to activate, and bring into a retail experience that they've never been into, and expose them to the content, to get them on boarded.

The second mode we operate in with that direct-to-consumer channel is very high end collectibles that, frankly, don't make a lot of sense at retail, either because of the price point or the margins that are available to bring those to market: high end box sets, complete collections.

If you take something like a six-volume Power Rangers set, there are Power Rangers fans that are certainly happy to engage with that, interested in that. The likelihood that you're going to be able to build that habit of having them come back to retail every single time and pick up those books, I think is diminishing, which we see reflected in the sales. You sell X number of copies of the first volume and then diminishing quantities on down. It gives us an opportunity to present that complete collection to those fans and say, "Hey here's a place where you can engage with it." Then we follow up and do additional marketing.

You said you're doing it because you believe there's a market outside of comic stores and bookstores. Lumberjanes, which blew up in the comic market, was the last Direct Reserve project. You launched Farscape before that, which is definitely a hardcore fan product. What makes you think there's audiences for those that were not being reached by your current channels? Aren't you worried about cannibalizing them?

I'll address the last question first, which is we haven't had any indication that the audience we’re engaging with through those channels is cannibalizing the traditional channels.

One of the things that we have done several times now with these large campaigns is actually asked them, "Have you ever purchased a graphic novel before? If you have, would you consider yourself a regular comic book or graphic novel reader? Then third, if you do, do you have a local comic shop or bookstore that you're regularly purchasing from?

With varying degrees, there's a significant percentage of the people that we're engaging with that will answer, “Yes, I've read a graphic novel before. Yes, I consider myself a fan of comic books and graphic novels. No, I don't have a regular outlet.”

We do have both anecdotal and empirical evidence that indicates that we are reaching that audience. We're always trying to expand it. In the case of Lumberjanes, it really is the opportunity to maybe not only reach a new audience, but a lapsed audience and give them a simple way to engage with this complete collection because it's eight volumes.

Is it possible that there's some overlap and some cannibalization? Certainly, I think that's possible if a retailer told me that they lost a sale on something. I don't have any reason to believe that's not happening on the margins, but I don't think that's the thrust of campaigns.

Do those Direct Reserve products ever make it to trade?

Yeah, so for example, for Lumberjanes the library editions will be released on a regular cadence into the book channel, into the comic shops. Generally speaking, we're communicating that out in advance, and if any retail partner wants to order the limited edition versions that we're offering through Kickstarter or BackerKit, we offer those at wholesale at whatever quantity they want.

Why not just put a retailer tier on the crowdfunding project?

Because it's confusing to the consumer. In our experience, the more complex you make the campaigns, the more likely somebody is going to get confused and just opt out of it. We try to make it as streamlined and straightforward as possible.

You'll notice that our campaigns max out at no more than 10 tiers. We also find that typically the retailer tier, you have to build it in a way where it's a bundle, it's five copies or whatever the case may be.

We tell retailers, and we have it on the campaign page in the FAQ, “Just contact us and we'll sell it to you wholesale. If you want to buy one set, that's totally fine.” We have had retailers contact us and say, "Hey, I have a customer who would like this set. They'd like to buy it through me." and we'll facilitate it that way.

Five years ago in our interview (see “ICv2 Interview: Ross Richie and Filib Sablik”), we talked a little bit about the share of your sales in these different channels. At that time, you said it was about 50/50 between direct and book market, and we didn’t talk about direct-to-consumer at all, which was...

Didn't really exist at that time.

How does that break down now?

Right now, in terms of channel mix, we are probably at about 45 to 50 percent direct market and then another 20 percent book market. Direct to consumer, right now, is in the 10 to 15 percent range. Then the balance of the pie is a combination of digital, foreign, and some other smaller channels.

Click here for Part 2.

On Market Conditions, BOOM! and Diamond, Direct-to-Consumer Sales, More

Posted by Milton Griepp on April 25, 2024 @ 12:32 am CT

MORE COMICS

Coming April 2026

July 28, 2025

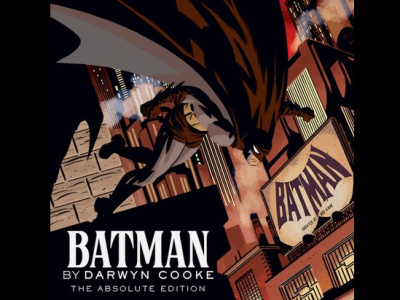

DC Comics will release the Batman by Darwyn Cooke: The Absolute Edition in April 2026.

From Marvel Comics

July 28, 2025

Check out the Marvel Rivals Swimsuit variant covers, coming this September from Marvel Comics.

MORE NEWS

Plus: Frank Miller Does Wolverine/Batman Backup Story for 'Deadpool/Batman' #1

July 28, 2025

The Marvel/DC crossover Deadpool/Batman #1 will have a backup story by Frank Miller featuring Batman and Wolverine.

Bonus Showbiz Round Up

July 28, 2025

Hollywood news has made it into bonus rounds after SDCC. So, this week, there is a Bonus Showbiz Round-Up!