It seems like a treacherous time to be a business owner or entrepreneur these days. Over the course of the last few weeks, the markets saw a 50 basis point hike in interest rates which triggered bear sentiment across the investment landscape. The stock market dropped more than 1000 points in a single day, cryptocurrency is showing weakness, and day traders are panic-selling to raise capital. 2022 is looking more and more like a dumpster fire and all asset classes continue to be punished as the negativity continues.

But is it really that bad?

As someone who has interacted with three to four bear markets (depending on the definition), I can pretty much say that this is par for the course, and the only thing different about this go-round is that the reactions to bad news are faster and there are different types of asset classes getting drubbed daily. The asset classes that should be of interest to the games and comics industry during this downward trend, are cryptocurrency and collectibles.

Over the course of 2019-2021, we have seen some truly incredible returns on collectibles. This epic increase in prices of collectibles was likely fueled by fast money coming from gains in short-term market investments and possibly cryptocurrency. It has been speculated that the returns from investments in Bitcoin or Ethereum over the last decade were manifesting into bidding wars for various collectibles such as original art comic pieces (see "Crazy Comic Art Prices…") and scarce Pokemon TCG cards (see "Card Sells for $900,000"). Though it is still unclear whether or not the cryptocurrency boom is the main driver of collectible price inflation, there is definitely a possibility that the wealth it created could be used to snap up rare, desirable items and a few examples seem to align the upward movement of crypto with that of certain collectibles.

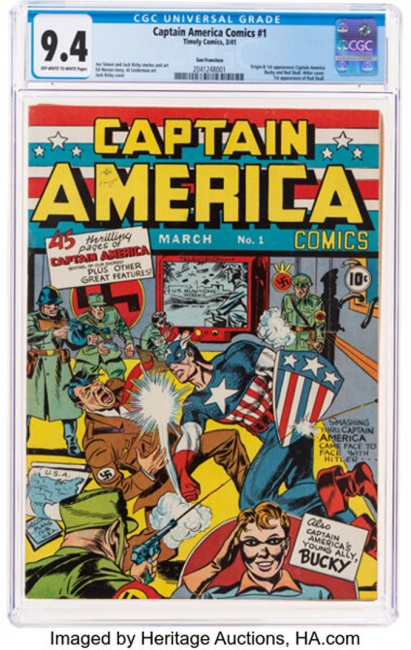

The most prominent example that coincides with the "cryptocurrency driving collectibles" theory is the tale of Captain America Comics #1. In 2019, a CGC NM 9.4 Captain America #1 from the San Francisco Pedigree sold for $915,000 at Heritage Auctions (see "'Captain America' #1 Gets Record Price"), which was a high price at the time. Less than three years later, the exact same book comes to market and fetches $3.12 million (see "'Captain America Comics' #1 More Than Triples"). A 3.4X return on investment in three years is practically unheard of for a graded comic book! Ironically, during that same time period, Bitcoin goes from around $10,000 a coin (August 2019) to above $42,000 (April 2022), which is also represents above a 3X return. While it is unclear whether or not Bitcoin had anything to do with the purchase of this comic, it is quite a coincidence that these two asset classes track each other almost in lock-step.

For games and comics business owners, the fear is that this near-term weakness and correction of the financial markets may leak onto main street at some point and begin to impact sales of collectibles. It might also be a bit of a compounded effect, thanks to inflation and gas prices already starting to limit consumers’ disposable income (see "Three Effects of Increasing Gas Prices"). I've already seen local retailers reacting to this by cutting expenditures and limiting inventory purchases to items that are customer preorder or surefire sales for the summer. This is also evident in the drop in Buy prices on TCG singles and sealed product, which have dipped by around 10% on various sites.

My general concern here is that emotion is beginning to get the better of business owners in this negative environment. Fundamentally, main street hasn't changed that much since the beginning of the year except for the impact of significant inflation, which had somehow been staved off since the early 80s (we were due), and increased commodity prices, mostly due to supply chain problems (see "Supply Chain Challenges") and the Ukraine-Russia War. People are still mostly employed, with the unemployment rate steady at 3.6% since March, and they are likely paid more as unit labor costs are up 11.6% in Q1. The money, for the consumer at any rate, is still mostly on the table as the hits being taken in the economy are mostly in retirement accounts as the market bounces down Wall Street like a rubber ball.

The moral of this story is: practice the art of consistency in times of negativity. The news cycle has been overwhelmingly negative, and the baby is getting tossed out with the bathwater on a daily basis in 2022. It sounds like an overused meme, but it is time to just chill, clear your head, and evaluate the actual footing your business stands on. From my experience, by the time most bearish sentiment has caused panic in the markets, the actual state of the economic world is already in the process of turning around.

The opinions expressed in this column are solely those of the writer, and do not necessarily reflect the views of the editorial staff of ICv2.com.

Column by Jeffrey Dohm-Sanchez

Posted by Jeffrey Dohm-Sanchez on May 10, 2022 @ 4:13 pm CT

MORE COMICS

Remastered Originals Followed by All-New Series

July 29, 2025

Capes will return with remastered versions of the long-out-of-print originals, followed by new stories in the same universe.

From Image Comics

July 29, 2025

Check out the covers for King Spawn #50, coming this October from Image Comics.

MORE COLUMNS

Column by Scott Thorne

July 28, 2025

This week, columnist Scott Thorne comments on the Edge of Eternities prerelease and on Magic: The Gathering news from the Hasbro earnings report.

Column by Rob Salkowitz

July 21, 2025

Columnist Rob Salkowitz lays out the Comic-Con panels of interest to industry professionals, current and aspiring creatives, educators, librarians and retailers.