As the dust from the holiday season settles, retailing news is coming in, and we round it up here.

Import volumes have fallen to pre-pandemic levels, unclogging ports and other import-related parts of the supply chain, according to a report from the National Retail Federation. Imports coming into the nation’s major container ports had been over 2 million Twenty-Foot Equivalent Units per month every month except one since August 2020 until this winter. November was 1.78 million TEU, and imports are expected to be well below last year’s volume for the next six months. The reductions in volume allows incoming shipments to move at close to pre-pandemic speed, and with more available capacity, prices are also dropping.

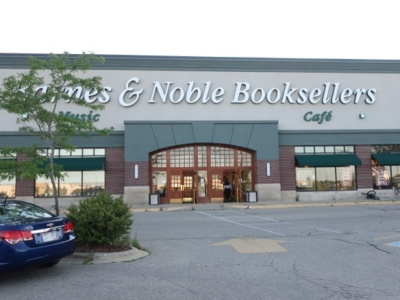

Online holiday sales from November 1 to December 31 were up 3.5%, according to Adobe Analytics, as reported by Chain Store Age. Although booked as online sales because of the ordering method, one in five of those orders were picked up curbside from retail stores. Toys saw substantial growth, but at big discounts. That’s a relatively slow rate of growth for online sales compared to recent years; brick and mortar growth is likely to be better.

Amazon is laying off over 18,000 employees, according to the Wall Street Journal, substantially more than the 10,000 reported in November (see “Amazon Laying Off 10,000”). The new round of layoffs is concentrated in the retail and recruiting areas of the company, according to the report.