Talk about your Friday afternoon news dump! As most of us were heading out for the holidays, word came on June 2 that notorious private equity firm Blackstone Tactical Opportunities had swooped down on Certified Collectibles Group, snatching up the parent company of comics grader CGC (see "Blackstone Acquires Majority Share of Certified Collectibles Group"). While the name of the organization calls to mind images of CGC executives being carried off by special forces troops in black helicopters, the transaction, as far as we know, merely involved the exchange of large sacks of money. In fact, the deal valued CCG at over $500 million.

That’s a lot to pay for a company that is essentially a middle-man service provider. CGC and the other collectibles grading services that are part of CCG don’t own or broker any of the big dollar collectibles that pass through their doors. They just put their imprimatur on them, sealing the goodies into plastic slabs tagged with a sticker assigning them a condition grade and provenance. They also maintain the survey data that, over 20 years, has become the weathervane for assessing true scarcity of collectibles, particularly those in highly-desirable top grades.

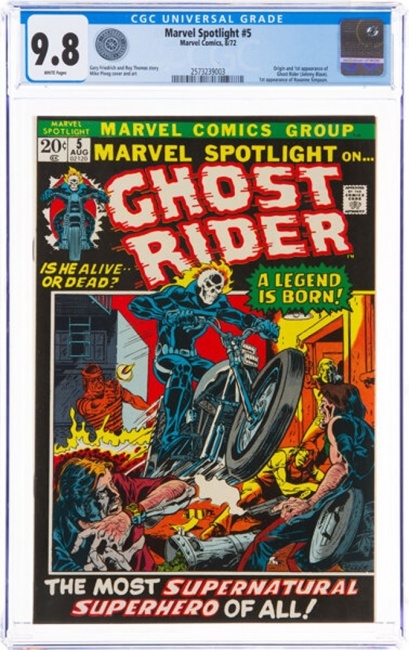

What’s driving crazy prices? Survey says… To a large extent, that data is what’s driving the nosebleed-level auction prices we’ve been seeing. Last week I spoke to Lon Allen of Heritage Auctions about the results of the June comics auction that saw, among other things, a 9.8-graded Marvel Spotlight #5, featuring the first appearance of the motorcycle-riding version of Ghost Rider, fetch over a quarter million dollars, setting an unlikely record for a Bronze Age book (see "First Appearance of Ghost Rider Sells for $264,000 at Heritage Auctions").

The reason this oddball issue that debuted a B-level (at best) character attracted a bigger pile of loot than more obvious targets like Incredible Hulk #181, X-Men #94 or Iron Man #55 is due to that survey data. Allen said that there are only four known copies of Marvel Spotlight #5 in 9.8, and after 20 years of collectors slabbing anything notable, the odds of another one coming out of the woodwork are fairly remote. Meanwhile, there are dozens or maybe hundreds of high-grade copies of those better-known books, so in absolute terms, the Marvel Spotlight #5 (9.8) is the rarer item. We wouldn’t know any of that without the data that CGC keeps on every book that passes under its microscope on the way to a slab and a grade.

Another thing the CGC survey does is point out the scarcity of high-grade comics relative to other categories of collectibles. Allen observed that comics look cheap compared to sports cards, which are changing hands for even more astronomical sums, even though card collectors are used to seeing thousands or tens of thousands of collectible cards in 9.6 or higher grades. When you’ve got comics in 9.8 condition in single-digit quantities across the entire known market, that suggests a magnitude greater degree of scarcity, even if Ghost Rider is not quite as well known as Wayne Gretzky or Lebron James.

It's all about the data. This brings us back around to Blackstone’s interest in CCG. As the last 30 years have shown us, those who control the data eventually control the market. Maybe being the doorman at the celebrity nightclub isn’t as good as being the owner of the club or one of the celebrities, but there is an awful lot of power in manning the velvet rope. The work is easy, the risk is low, and the tips are good.

Is that by itself a half a billion dollar business, even if the volume and value of the market continues to go up? Maybe not today. But Blackstone makes its money looking at future potential, not just present earnings.

CGC Founder Mark Salzberg, who retains a significant minority stake and presumably a voice in the ongoing operations of the company, said his initial vision was to "transform collectibles into an asset class that is trusted by collectors, dealers and investors around the world."

Asset class is a term used in the world of finance to denote an investment that represents a store of value. Stocks, bonds, precious metals, real estate and commodities are all "asset classes" that present known risks and rewards to investors. Comics, with all their insider lore and clubby collector culture, posed too high a barrier to entry for casual investors seeking return on investment. But comics mediated by a trusted third party, sealed in tamper-proof cases, with a known provenance and authentication? That is literally as safe as houses, and consequently, comics are now selling like luxury real estate. Mission accomplished, Mark Salzberg. You must be proud.

Where this is probably headed (yes, NFTs, sorry). Another interesting line that jumped out of the announcement was from Blackstone Principal C.C. Melvin, who noted that the company has been tracking the rise of the physical and digital collectibles industry "for several years."

Did you catch that? I’ll play it again. "Physical and digital collectibles."

By digital collectibles, perhaps he means NFTs, because, what else could he mean? (Disclosure: I am doing business with a company in this space). But if that’s the case, what possible role would CCG have? One of the advantages of digital collectibles is that the provenance is built into the technology. The whole point of the blockchain is to have an immutable and authoritative chain of custody of the digital token from the moment of its minting to the present moment. That not only guarantees that any item can have one and only one owner at a time, it also provides a record of sale, an absolute guarantee of authenticity, and a permanent survey of the extant supply of every token in circulation.

And of course, condition isn’t really a factor. Bits don’t crack, fox or yellow, and you can’t spill a beer on your near-mint copy of Marvel #1 if it is stored safely in the cloud. We can safely say all your NFTs are pristine 10.0s and will stay so for eternity. No CGC required, thanks.

Things get interesting once you start to combine the risk-reduction aspects of turning collectibles into an asset class with the convenience and liquidity of digital commerce. One of the knocks that traditional collectors lob at NFTs, whether we’re talking limited edition digital collectibles or one-off digital works of art, is that there’s no there there. What is an NFT, after all, except a complicated mathematical formula? How could it ever be worth anything in the way that a paper copy of Marvel Spotlight #5, printed 50 years ago and preserved in near-perfect condition, could be – even if we can prove that there are exactly as few or fewer editions of the NFT as there are of any given physical collectible?

But what if an NFT represented, or was "backed by," a unique physical collectible, in the same way that greenback dollars, or "fiat currency," in the terminology of the crypto-enthusiasts, was once redeemable for gold? What if the NFTs representing unique, individual collectibles like a CGC-graded copy of Marvel Spotlight #5 could be traded on a digital exchange while the actual physical goods were stored in a secure, climatized, well-insured warehouse until and unless the current owner of the NFT "deed" to that particular item demanded delivery of the physical good? That would solve a bunch of problems for any buyer concerned about taking custody of a fragile artifact or shipping a high-value item across international borders, and it would make the resale of that item much easier and more transparent for reasons mentioned above.

Like CCG’s collectible grading and certification system, this would be another mechanism to reduce the risk of trading in comics or other collectibles as if they were just another class of financial asset, rather than items with specific artistic, historical or sentimental value. It’s not clear whether a Blackstone-financed CCG has the interests or capabilities to stand up such a model on their own, but I have it on excellent authority that someone does and those conversations are already taking place.

Money, get back. For Blackstone, an organization purely and exclusively dedicated to financialization for its own sake, taking a stake in the strategic heights of the collectibles industry probably seems like a golden opportunity. We don’t really have to guess about that: they’ve said as much, both with their words and their money.

This is where collecting has been heading for the past several decades, and it accounts for a lot of the craziness that’s taken over the comics and original art markets, among others, in recent years. Money, moving in large enough quantities at fast enough speeds, attracts more money. It’s like a rule of physics. Blackstone has just supercharged that system with a massive investment in the instrument that regulates and accelerates the whole market apparatus.

The effects of this are still unlikely to trickle down to the lowest strata of the hobby, although a speculator bubble in manufactured "collector’s items" is never out of the question in our business. At the top levels, though, we are about to hit escape velocity. I hope we survive the experience.

The opinions expressed in this column are solely those of the writer, and do not necessarily reflect the views of the editorial staff of ICv2.com.

Rob Salkowitz (@robsalk) is the author of Comic-Con and the Business of Pop Culture.

Column by Rob Salkowitz

Posted by Rob Salkowitz on July 6, 2021 @ 5:56 pm CT

MORE COMICS

From Frank Miller Presents

April 25, 2024

Abrams ComicArts will publish book format products by comics auteur Frank Miller, from his eponymous company Frank Miller Presents.

'DC Versus Marvel Omnibus' & 'DC Versus Marvel: The Amalgam Age Omnibus'

April 26, 2024

Check out the final cover artwork by Jim Lee for the upcoming Direct Market editions for the DC Versus Marvel and the DC Versus Marvel: The Amalgam Age omnibuses.

MORE COLUMNS

Column by Scott Thorne

April 22, 2024

This week, columnist Scott Thorne looks at Asmodee's new Minimum Advertised Price policy, and the departure of the Wizards of the Coast president.

Column by Rob Salkowitz

April 15, 2024

This week, columnist Rob Salkowitz deconstructs recent discussion of WEBTOON"s creator contracts to look at the issues around creators' rights when there's a lot at stake.